St. Petersburg, Florida | October 29, 2019

More than $46B in loyalty points is sitting untouched in loyalty program accounts. With new data protection laws and anti-fraud software for banks and financial institutions it is no surprise that fraudsters are tapping into less secure currencies for easy wins.

The loyalty fraud industry spent a full day discussing, brainstorming, and swapping stories around how leading loyalty programs are combatting fraud in their programs.

The point of failure is often the point of human interaction

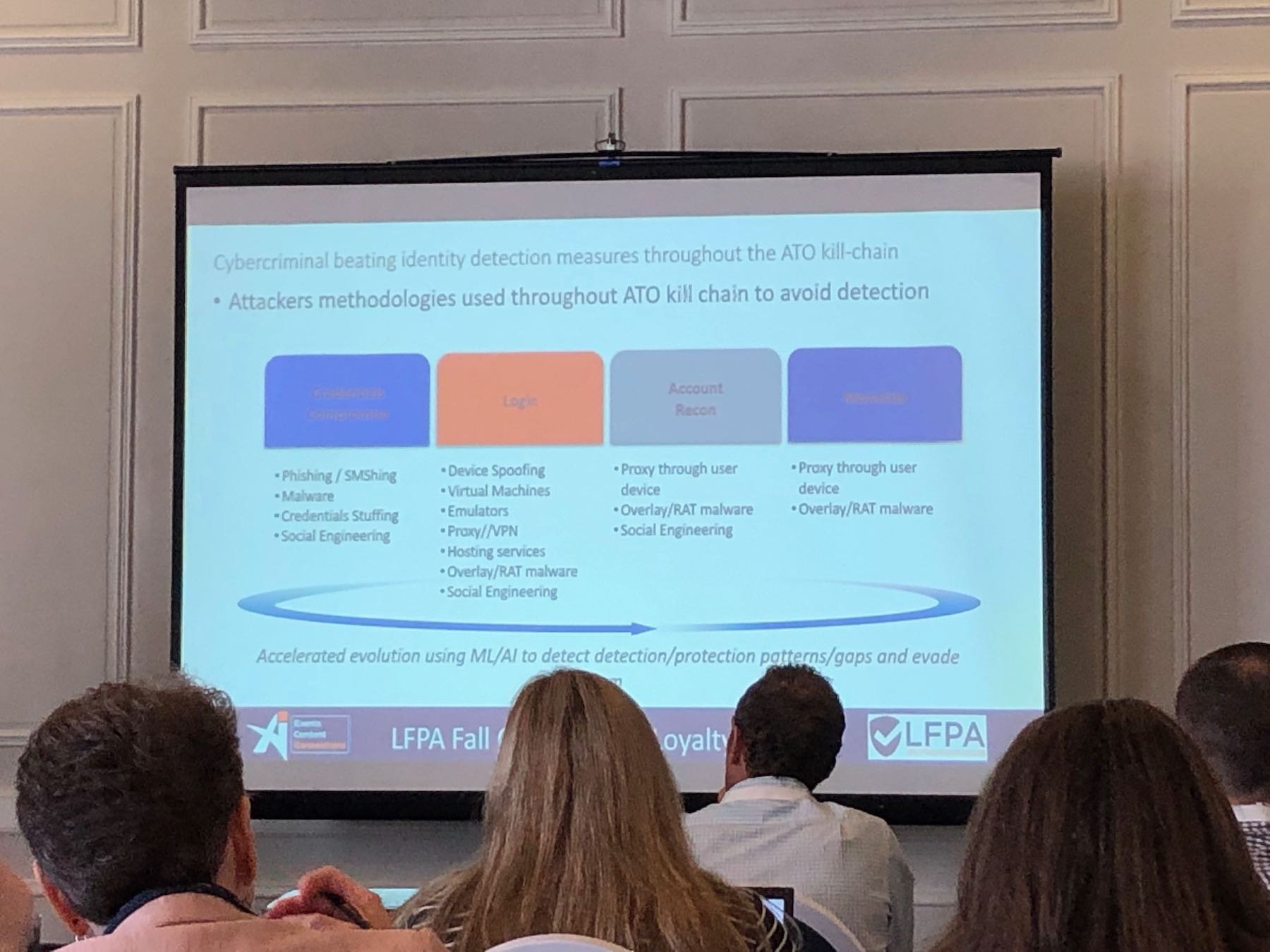

Machine learning and AI have made fraud detection incredibly robust. We can detect fraud with a high degree of confidence through behavior, software, hardware, and geo-location.

So fraudsters are now using call centers and customer service reps as the point-of-entry for their attacks. Well meaning CX reps give in to smooth talking con-men who are looking to transfer points, merge accounts, or change contact information. Keeping front desk attendants, customer service reps, and receptionists trained and aware is a crucial last line of defense against fraud.

"We try to empower our employees, because that allows them to provide the absolute best customer experience. But we're unwittingly making fraud easier when we loosen up the controls," said Kenneth Purcell during a panel on end user education.

Loyalty fraud (and fraud in general) is extremely difficult to prosecute.

When asked how many instances of fraud resulted in successful convictions, Els Villanueva of KLM responded "4." That's 4 out of 1000's of cases of fraud. A key challenge to successfully catching fraudsters is that most fraud is committed across borders, and extradition for financial crimes can be a tough proposition.

English is the lingua franca for fraudsters

Even for international companies with multi-lingual staff and customer care, most fraud happens in English.

A cottage industry has popped up to help casual fraudsters

Need a fake receipt to submit as proof of your damaged item? Visit fakereceipts.us. Need to doctor a copy of a drivers license? There are hundreds of tutorials. Fraudsters often rely on visual proof and the internet makes 'shopping documents easy.

The dark web has user reviews and money back guarantees

During a demo of the dark web from Sift Trust & Safety Architect, Kevin Lee, we saw loyalty accounts from companies like Marriott, Wyndham, and Delta for sale for as little as $2. Users selling the information had star reviews, indicating

Even more nefarious were the "daily specials," which showed which newly breached company data was trending that day. The site looked scarily similar to a standard eCommerce page, just instead of hotel rooms or flight listings there were lists of compromised user accounts. And instead of US dollars or Euro you pay in bitcoin or cryptocurrency.

Marketing + loyalty fraud prevention = <3

We met loyalty fraud prevention specialists from companies like Wyndham, Southwest, and Air Canada and all of them said that fraud prevention and marketing working together is one of the best ways to combat fraud.

"The promos and different earn rates, and changing incentivized behaviors is one of the things that makes loyalty programs so fun," said Dave Andreanakis of Kobie Marketing. "However, every one of these promos is essentially a modification of the terms and conditions, and opens up opportunities for fraudsters to take advantage."

Bringing the fraud team to the table when launching new promos or partnerships helps programs be more proactive and saves teams from feeling pain down the line.

Overall takeaways

With more than 150B loyalty points processed annually on our platform we are no strangers to sussing out fraudsters who would take advantage. We left Loyalty Fraud Prevention Conference invigorated in using a combination of software and human training to help stop fraud.