The number of hotels offering room service continues to plummet. New research, “The Future of Room Service” surveyed hundreds of travelers and reveals emerging trends in room service, in-room dining, and food delivery to hotel properties.

A new white paper commissioned by iSeatz, a technology company providing digital booking experiences that integrate with loyalty programs, titled The Future of Room Service: Craving for in-room dining, food delivery and online grocery delivery trends amongst U.S. Travelers researched by Phocuswright, shows that travelers are interested in purchasing more than just rooms from hotels, especially if the ancillary is connected to the hotel’s loyalty program.

The ancillary industry is forecasted to hit $93 Billion worldwide. Although some airlines, like Allegiant, earn the majority of their revenue through ancillaries, hotels have been slower to adopt the strategy.

The report focused on consumers interest and usage in three main areas: traditional room service, and both food delivery and grocery delivery while traveling. Key findings include:

- Seven in ten respondents have great interest in local food experiences when traveling.

- ‘Ease and convenience’ are the key motivating factors for ordering both traditional room service and online food delivery.

- Value for money is the #1 challenge for selling traditional room service. Ironically, from the hotel perspective, providing room service is also uneconomical.

- 67% of business travelers and 48% of leisure travelers have already used a food delivery app on a recent trip.

- Third-party food delivery platforms offer the potential to supplement/replace traditional room service in metropolitan areas.

In addition to detailing the traveler interest in in-room dining, the white paper also explores the hotelier’s perspective of in-room dining through a series of interviews. Offering room service to guests in most hotels is a loss leader. In 2018 the average F&B departmental profit was 28.4% for all U.S. full-service hotels, but only 23.2% for properties with significant in-room dining revenue, demonstrating that providing this service has a negative effect on hotel performance. Despite this, room service is often maintained because of outdated brand standards or, to a lesser extent, due to customer expectations, particularly in luxury properties.

The situation is well-summarized by the F&B manager of a well-known New York City hotel who exclaimed, “Why would I promote my in-room dining? I lose a fortune on every order!

Download the entire white paper: http://bit.ly/329pfoI

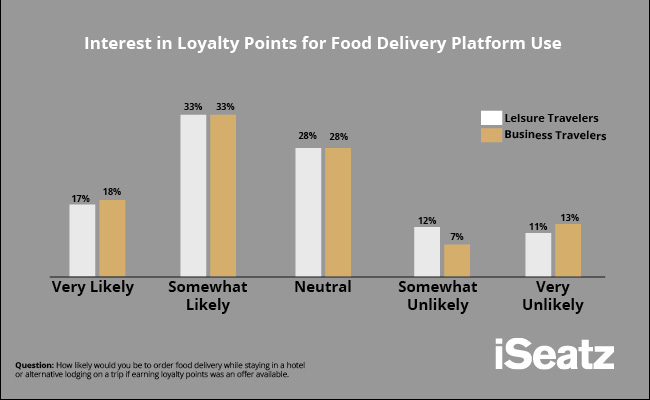

Data Preview:

Two of the top five largest hotel chains have already embraced food delivery. In November 2017, Intercontinental Hotel Group (IHG) was the first hotel brand to launch a food delivery partnership, allowing members to earn IHG points for food delivery with Grubhub. In April 2019, Wyndham Hotels & Resorts launched a similar partnership with DoorDash as a way to facilitate in-room dining at their limited-service hotels, which make up approximately 80% of the hotel group’s portfolio.

“When I founded iSeatz in 1999 it was to solve a problem - streamline restaurant reservations through technology. Twenty years later, we wanted to revisit our roots of providing technologically-advanced dining opportunities to hotel guests by commissioning this survey on in-room dining. said Kenneth Purcell, Founder and CEO of iSeatz. “The Future of Room Service’s goal is to understand the modern travelers’ needs and interests around in-room dining; and potential solutions to lift the operational burden hoteliers face with traditional room service. Our goals are to help automate and simplify the search, booking and management of a myriad travel and related goods and services; to suggest innovative paths to purchase; to capture responses; and to optimize the user experience.”

This whitepaper is the third survey produced by Phocuswright and iSeatz. In Spring 2018, Business Travelers’ Demand for Ancillary Services was published as a companion piece to Hotel Ancillaries: An Unexplored Opportunity which focused on the leisure traveler’s interest in ancillary products.

Methodology

Our study of current developments in in-room dining was approached from two complementary angles. Initially, to understand the demand side, Phocuswright carried out a mass online consumer survey in March 2019 through Dynata, targeting the general U.S. adult population who has internet access. To qualify for participation, respondents had to have taken at least one trip at least 75 miles from home in the past 12 months that included

paid lodging. Phocuswright received 800 qualified responses, which can be projected with confidence onto the U.S. online traveler population. The error interval for analysis is +/-3.5% at a 95% confidence level.